Content

This might indicate using more hours inside than just you’d prepared to have the newest purpose of one’s fitness. Just like any money, anyone may have to waiting some time to feel the full effect of the funding. For the time being, there are certain actions you can take to store yourself secure from the days ahead.

- While you are not knowing if you received the money, there is a good way to evaluate using your Irs membership on line, taxation professionals say.

- The amount of banking institutions to the listing enhanced from 52 inside the next one-fourth 2023 to 63 inside the very first quarter 2024.

- The newest competitive Bash-Off because of the Light Household away from a lot of time-identity Treasury efficiency and also the money because the January did.

- This type of ties secure desire according to a mix of a fixed price and you may an adjustable speed that is tied to the speed away from rising prices, since the measured by Individual Speed Directory to own Urban People (CPI-U).

RHB repaired deposit cost

In addition, it setting the methods that individuals all of the reduce and you will getting less effective whenever doing work in the warmth. And it’s work specialists, too, which realize that they are able to’t consider equally as obviously for the months if the air conditioner is’t match ascending temperature. By comparison, just last year’s number-cracking All of us hurricane 12 months brought about an estimated $60-$65 billion inside the economic losses. Tall temperature and tends to escape our interest as the study to the its outcomes are without having and the issue is hard to measure. Surveying the new wreckage out of an excellent exotic violent storm, we can assess their costs to your economy and you may toll within the existence. It’s more complicated to measure the fresh feeling of something while the insidious and you may prevalent because the ascending june temperatures.

Best repaired put cost for a great 6-day and you may 12-month union attacks

Friend Dedicate Advisers and you will Friend Invest Securities are completely owned subsidiaries from Friend Financial Inc. Bonds items are Perhaps not FDIC Insured, Perhaps not Financial Guaranteed that will Get rid of Well worth. While in the their tenure, Friend might have been constantly recognized by consumers as well as the world as the “finest in group,” in addition to 11 recognitions to the Money Magazine’s Better Online Banks list. In the 2021, Talwar and you will Friend disrupted once more, top the within the reducing overdraft fees once and for all. The newest agency is even revising criteria for informal revocable trusts, labeled as payable on the death account.

When you’re costs spent on making repairs are deductible, the price of improvements to team possessions need to be capitalized. Fool around with the beneficial books and you may service services to assist perform all the of your own banking more readily. Reinvest the money inside a different name put (either to your focus provided, otherwise after the desire try repaid to you personally). It’s simple and fast in order to roll-over and also create fund to the label put in the readiness using NAB Sites Financial otherwise the new NAB software. People who discovered SSI and you will Public Shelter, and those who become getting Societal Security ahead of Will get 1997, also provide a tweaked agenda which week.

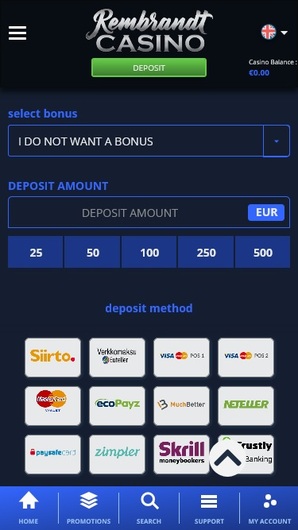

Therefore remain specified limits in your mind whenever stating gambling enterprise added bonus currency. Don’t rush to the grabbing a flashy $a hundred bonus – larger isn’t constantly click over here better. Check always the newest conditions and terms prior to saying a no-deposit added bonus to ensure you’re also bringing genuine value. This current year-stop tax-believed publication is based on the existing government taxation laws, rules and regulations. It is subject to alter, particularly if additional taxation regulations is enacted by the Congress through to the end of the year. Although this publication provides an over-all framework, your specific issues have earned customized interest.

Regarding your work with count, even if, there are some points that may connect with how much you discovered. If you would like higher costs, consider the lending company of Asia (2.50% p.a good.) or ICBC (2.40% p.a.) with only $500 to possess a good 3-few days tenor. The newest not so great news would be the fact it comes down with highest minimum deposit amount of $a hundred,000. For individuals who don’t fully grasp this amount, HL Financial is not also an alternative for your requirements.

Better 5% Focus Savings Profile of 2024

To make sure, some of the said assets wanted savers to remain lay to possess a designated period of time, and may also require some fund to be forfeited when they cashed in early. But since the cost savings will continue to perform well and inflation is actually nevertheless higher than the newest main bank’s dos% target, forecasts for how much costs will come down and if have end up being quicker particular. In the stop out of 2008 because of mid-2022, such Computer game stability had plunged by 97%, inspite of the rate-hike hump in the 2018. These types of brief Cds are extremely sensitive to rates; they’lso are maybe not “sticky” after all. Review the characteristics and you will Risks of Standard Choices pamphlet before you begin trading options.

At the same time, damage in certain loan profiles, such office characteristics and you will mastercard finance, will continue to warrant monitoring. These issues, in addition to financing and you can margin demands, will stay things away from ongoing supervisory focus by the FDIC. The rise in the noncurrent mortgage balance went on one of non-owner filled CRE finance, driven by the place of work money in the premier financial institutions, those with possessions higher than $250 billion. The next tier from banking institutions, individuals with overall assets ranging from $ten billion and you may $250 billion within the possessions, is even appearing certain be concerned in the non-holder filled CRE financing. Poor demand for office space is actually softening assets thinking, and better rates of interest is actually impacting the financing quality and you will refinancing function of work environment or other form of CRE money.

Why are a knowledgeable Highest-Produce Discounts Profile?

Starting otherwise moving more a phrase put, to have a phrase higher than 2 yrs, is not found in branch otherwise thru cellular phone. With regards to the newest study from the Public Shelter Management, from the 7.4 million somebody discover SSI per month. The thing that makes development and you may rates for We ties discussed to the an excellent webpages from the rising cost of living? The new overall performance ones bonds is actually closely connected to the rate away from inflation. Actually, Series We deals ties are a kind of You.S. bodies bond designed to safeguard up against rising cost of living. These types of bonds earn interest centered on a mixture of a predetermined rate and you may a changeable rates that is tied to the rate away from inflation, as the measured from the User Price List to possess Metropolitan People (CPI-U).

Recent Comments